Where To Invest In Indiana: Muncie, IN

The city of Muncie, Indiana is located in Delaware County around 50 miles northeast of Indianapolis. Muncie’s name came from a tribal town called Munseetown which was established by an Eastern Tribe known as the Delawares. In 1865 the city was officially incorporated and became the Delaware County seat. Later on, the city became a […]

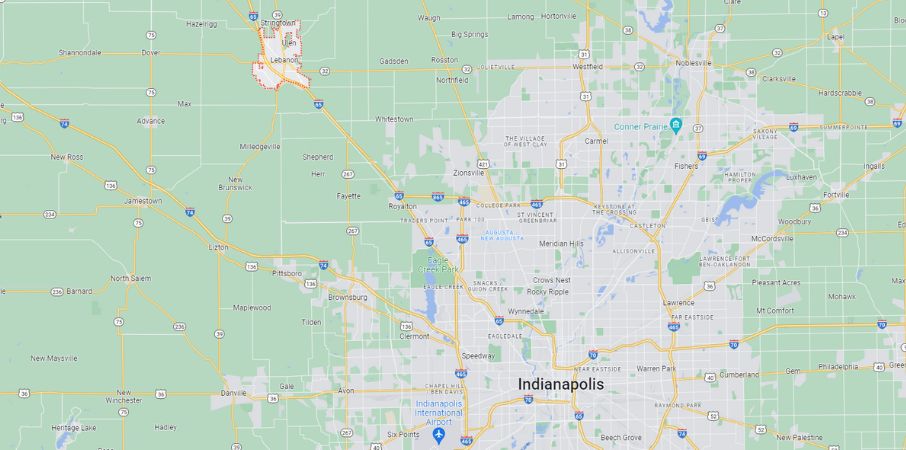

Where To Invest In Indiana: Lebanon, IN

Lebanon, Indiana was founded back in 1830 by two men who served in the Indiana Militia named Colonel George L. Kinnard and General James Perry Drake. Adam Frenh is the man who named the city. After seeing a cluster of hickory trees that he believed looked like the Cedars of Lebanon from the Bible, he […]

Where To Invest In Indiana: Greenfield, IN

Greenfield, Indiana is a city rich in history and full of attractions. In 1828, the county of Hancock was created in April, and a month later, Greenfield was founded as the county seat. At that time, the small town had a population of only 400 people. Since then, Greenfield has had major periods of growth. […]

Where To Invest In Indiana: Mooresville, IN

The small city of Mooresville, Indiana currently has a population size of 9,727 people. Founded in 1824 by Samuel Moore, who the city was named after, Mooresville, is now home to several attractions including a few historic sites. If you are visiting or living in Mooresville, you can explore the White River State Park and […]