In our last blog, we talked about the various aspects of the Owner Portal.

One of those topics related to the Owner Portal is so important, that it’s getting its own article.

Owner Statements and Owner Draws.

Owner Statements

Owner Statements provide you with vital financial information and give you a detailed breakdown of how your investments are performing.

Look, we know you may not be an accountant and some of our Owners struggle with how to read our Statements.

We’re here to help, so let’s dig in and review.

When Do I Get My Statements?

There are 2 occasions when you will receive a statement.

- Monthly: We post a statement to your Owner Portal each month. This is generally done between the 3rd and 5th of the following month. For example, you will receive a statement for all of May’s activity around June 3rd. You will be notified, via email, when we a new statement is available for you to review on your Owner Portal.

- Annual: We also send out an annual year-end statement to all of our Owners. This shows your total income and expenses for the whole year and is typically the document you will give to your accountant come tax time.

These documents will remain in your portal for you to go back and view as long as you are a Client of ours. If you need to go back and find a past statement, you can simply filter by time period.

What Will I Find on My Monthly Statement?

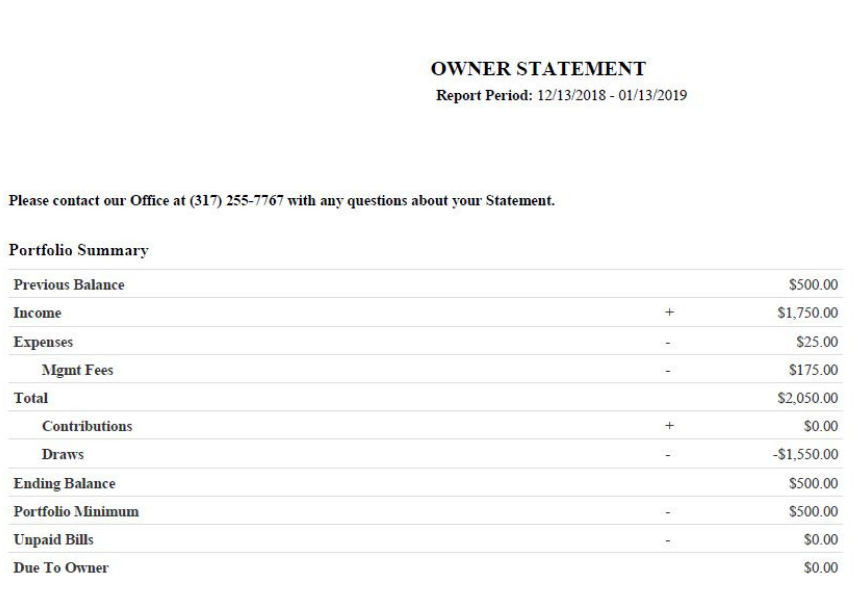

There are 4 main components of the monthly statement:

- Overview – This section gives a top-level, list view of income and expenses for the reporting period. As you should know, we require at least $500 in your account at all times to pay for expenses, so this should represent the beginning or “Previous Balance” to start the period.Most of the other categories listed should be self-explanatory.

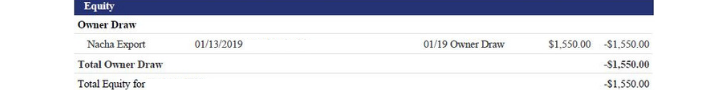

2. Equity – In this context, Equity simply means an exchange of funds. This could be us paying you, or you paying us for varying reasons. In the case listed below, the Owner is receiving a draw of $1,550. However, if the Owner made a contribution for carpet replacement, for example, that would show up as a “Contribution” in the Equity Section.

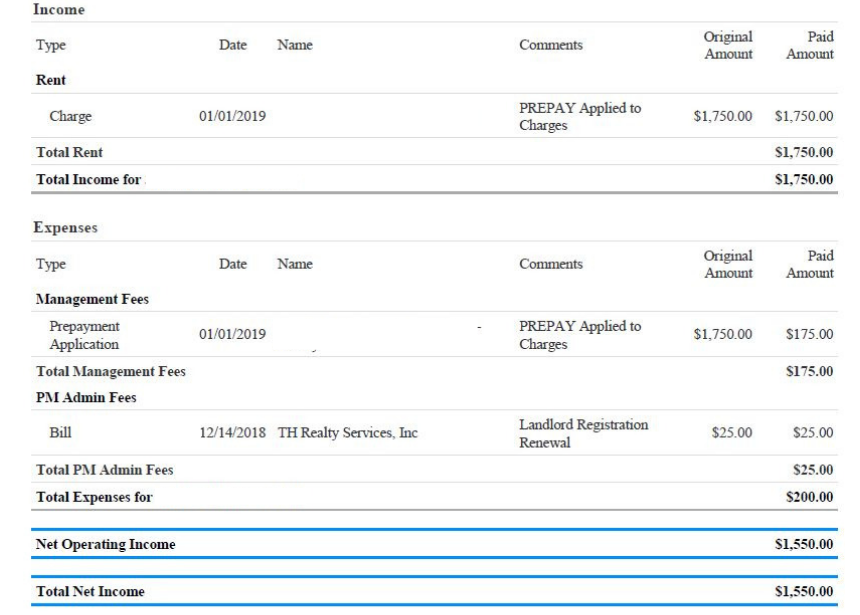

3. Detailed breakdown by property – Here is where you can see exactly what your income and

expenses came from for each property that you have under management with us. In many cases, the “Comments” section should provide the details you need regarding any income or expense item. However, if you want to see further detail, specifically regarding maintenance, we will reference the work order involved in the Comments section so you can get more information.

4. Unpaid Bills: This section will list any unpaid bills you have with us. Generally, these bills will include monthly bills that we pay, which may include items paid by credit card or supplies purchased on our Lowe’s account.

Please note that these bills have been set-up, but not yet paid, and your funds will be held during an Owner draw. For example, let’s say that we purchase plumbing materials at Lowe’s for a repair at your property that total $50. Our technician will submit the receipt to our Bookkeeper, who will set-up the bill to pay. This will show as an unpaid bill, which may not be due for several days. Let’s also assume that we generate draws the next day. In this case, our system will hold back the $50 since it knows we will eventually pay the bill.

Owner Draws

Owner draws, as you probably know, are when we disburse rents to you.

It’s payday, in other words.

When Should I Expect a Draw?

We conduct Owner Draws every Friday. If that happens to fall on a Holiday, we will conduct the draw the following Monday.

Note: You will not be notified by us when we initiate a draw to you. However, inside your Owner Portal, we’ve provided a dynamic Owner Statement that details all your activity for the past 30 days. Any draw that we’ve initiated for you will be detailed on this statement.

A few additional notes about monthly statements:

- Once we initiate a draw, the funds should hit your designated account within two business days.

- Not every month will be a payday. Some months, your expenses may outweigh your income and that is just part of being a Landlord.

.png)