As a current or future Real Estate Investor, you’ve likely given some thought as to what type of rental properties you want to acquire.

The big debate really comes down to 2 main categories, single-family (SFR) vs. multi-family (MFR).

So, which one is right for you?

Both have their advantages and disadvantages, and similar to most other real estate investing questions, the answer is….

“It really just depends.”

It depends on your investment goals, strategy, and overall end game.

You’ll find convincing arguments for both SFR and MFR, leaving it up to you to weigh the pros and cons of each to determine what will be the best route for you.

And that’s just what we hope to help you do as we provide insight into both investment types.

Note: For the purposes of this blog, single-family will refer to single-family, detached homes. We have an entire blog that discusses the pros and cons of investing in condos.

Indianapolis Real Estate Investments: Single Family vs. Multi Family

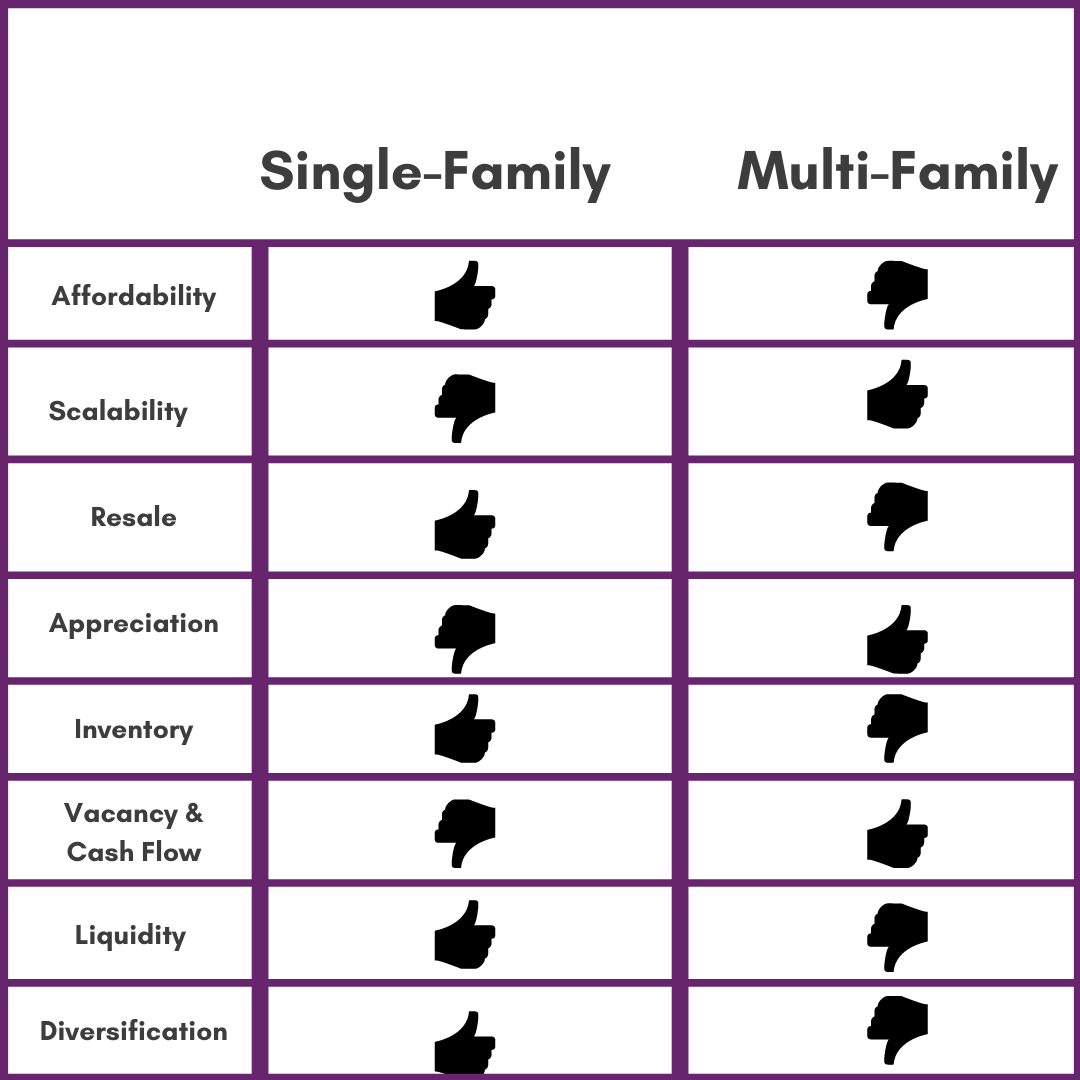

- Affordability and Financing

One of the most appealing aspects to investing in SFRs, is that it’s relatively easier and cheaper to get started.If you decide to utilize financing, most lenders simply require 20%-25% down with a conventional loan.

To be fair though, single family and small multi family (up to 4 units), are pretty similar when it comes to purchase prices and financing. Most lenders will treat these loans the same.

The real comparison comes into play for larger, multi-family complexes. The purchase price will obviously be much higher for a 10-unit apartment building as opposed to a single family investment property (unless you’re looking in Carmel, Indiana perhaps.)

Additionally, most lenders will require a commercial loan for large MFRs.

Some investors argue that large multi-family properties are easier to finance as lenders look more closely at the performance of the building as opposed to personal assets, etc.

It’s important to shop around and find a lender who can provide the rates and terms that work best for you.

- Scalability

If you’re looking to build a large portfolio quickly, then multi-family is the way to go.

You can scale much quicker as every deal you close contains multiple “doors”.

If your goal is to have 10-20 units closed in one year, you can theoretically achieve that with just one purchase.

If you want to achieve the same with SFR, you have to find 10-20 individual houses and go through the entire process 10-20 times.

It’s a lot more work and in this highly competitive market, it’s no easy feat.

- Resale opportunities

Exit strategy is important in the real estate business whether you’re a flipper or a buy-and-hold investor.

The re-sale pool for single-family homes is significantly larger than that of multi-family properties.

Anyone could be interested in a single-family home, both owner occupants and investors alike, whereas the market for multi-family is solely investor driven.

In most cases, the resale market will be better for SFRs than MFRs.

- Appreciation

While SFRs may have better resale potential, MFRs may have better appreciation potential.

The value of a single family home is almost solely tied to recent comparable sales in the area and what the current market is dictating.

That can severely limit your sale price options.

Conversely, multi-family property values are more dependent on the income being generated and how it’s performing as an investment, which provides the potential for much better and faster appreciation.

- Inventory

Currently in the Indianapolis market, there are significantly more SFRs than MFRs available.

As of this week, there are a little over 3,660 single family homes listed on the MLS in the Central Indiana area, and only 128 multi-family properties.

With this ratio, you obviously have a much larger pool of deals to pick from on the single-family side.

- Vacancy and Cash Flow

Unless you have a larger SFR portfolio, MFRs will likely end up providing higher monthly cash flow and better returns in many cases.

In a multi-unit property, if one tenant vacates, you still have tenants in the other units to keep generating income and cover expenses for the building.

If you only have a couple single-family properties, vacancy kills your cash-flow.

As a Landlord, it’s important to have proper reserves in place to get you through vacancies.

- Liquidity

With SFRs, if you ever get into a situation where you need some extra cash, or an investment just isn’t working out, it’s relatively easy to sell one or two properties and liquidate some assets without giving up all or most of your portfolio.

That’s not usually the case with MFRs. As we discussed earlier, the buyer market is smaller and it may not be so easy to find a taker.

By selling an entire MF building, you may also be giving up a large portion of your investment portfolio before you’re ready to.

- Diversification

One perk to investing in SFRs, is diversification.

You have the ability to invest in different markets, classes, and property types in order to figure out which one performs the best for you.

With MFRs, you’re forced to put all of your eggs in one basket.

Is Single-Family or Multi-Family Right for You?

As you can see, there are quite a few factors to consider when it comes to what type of Indianapolis real estate investment you want to pursue.

There are obviously pros and cons to both, and arguments can be made why one is better than the other.

You may even find that a combination works best for your investment goals.

If you’re new to the REI world, you may consider getting your feet wet with a single- family or small multi-family home before diving head first into a large multi-unit property.

Whatever you decide, make sure you do your research, due diligence, and have a good team to help you through the process from start to finish.