If you’ve been investing in real estate for any period of time, or even if you’re just in the research phase, you likely know about property classes.

Just in case you’re brand new to REI and have no clue what I’m talking about, there’s an informal grading system that investors use to classify properties.

Yes, I mean literal grades such as an “A” property or “C” property.

I say it’s informal because everyone has their own variation and subjective opinions about what each grade constitutes.

One investor may think a property is a “B” class while another considers it a “C”.

Some grade on an A-B-C scale while others go all the way down to an “F”.

Some go even more in depth by adding pluses and minuses into the mix.

But with all that aside, at its core, the grading system is universally known and is an important factor to consider because each class represents a different level of risk and return.

As a company who manages mostly A/B properties, we are often asked what those types of properties look like.

So, we thought we would take some time to break down each class, provide some real life examples from right here in Indianapolis, and hopefully be able to help you determine which class of property best fits your investment goals.

For the purposes of this blog, we’re going to use an “A” through “D” scale.

“A” Class Properties

These properties are the cream of the crop.

If “A” class homes were a high school student, they would be that kid who had a 4.0, did community service on the weekends, excelled in sports, and was nice to everyone.

In more technical terms, these properties are usually newer, built within the last 10 years or so. They have all of the in-demand features such as granite countertops, stainless steel appliances, hardwood floors, etc.

These properties are typically located in the best areas near award-winning schools with popular dining and shopping options. You can expect these properties to attract the highest quality tenants willing to pay top dollar.

Pros: “A” class properties are certainly the lowest risk investment you can make. Since they are typically newer, you may not have to worry about excessive maintenance issues and you’ll most likely have solid tenants who take good care of the home.

Cons: With high-end amenities and tenants comes a high-end price. These properties are not going to provide much, if any, cash flow. “A” class investments are for those who see the benefit in long-term appreciation.

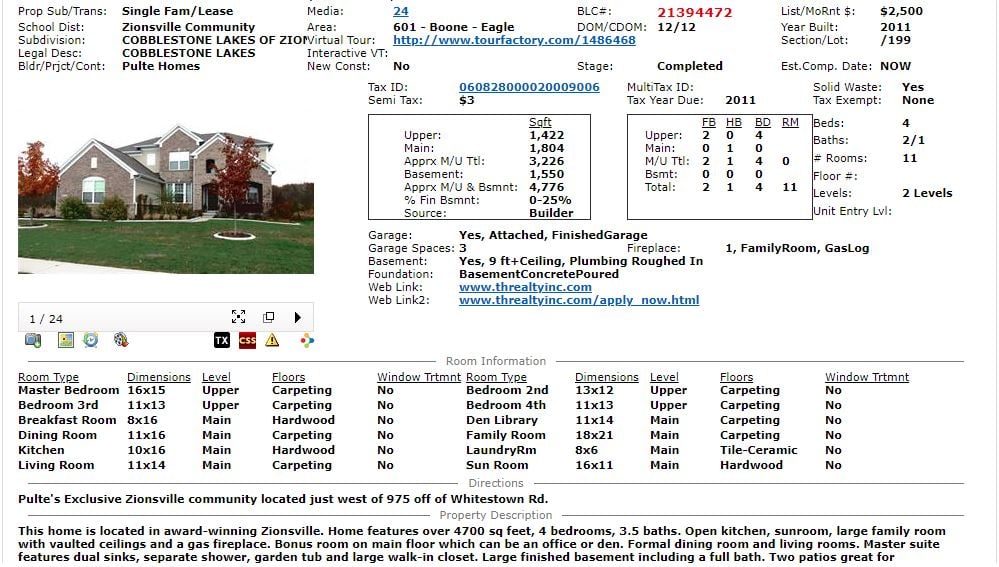

Local Example:

Below is a snapshot of a property we manage.

This home checks all of the boxes for the “A” class category as it:

- Is less than 10 years old

- Is located in Zionsville, a prestigious area in Central Indiana

- Has high-end features such as granite countertops, hardwood floors, stainless steel appliances, beautiful brick exterior, and a ceramic tiled bathroom

- Rents for $2,500/month

- Purchased in the high $300,000 range

“B” Class Properties

These properties are selling like hot cakes in Indianapolis right now.

Just one step below the premium “A” class, “B” class homes offer solid investments with a much

These homes are usually a bit older so they’ll have some wear and tear. They won’t have the newest and best amenities, but should be in very good condition overall.

They are also in desirable areas and offer proximity to good schools and entertainment.

You can expect these homes to attract more of a “working class” tenant which is nothing to scoff at, but is slightly riskier as they are sometimes on a paycheck-to-paycheck lifestyle.

These are the properties that many owner-occupants are looking to purchase as well so it creates a high level of competition for investors.

Pros: “B” class properties offer investors a solid investment at a manageable price point. Since you’re taking on a little more risk, you can acquire them at a higher cap rate than “A” class homes.

Cons: While “B” class properties do offer more growth potential, you still may not see an abundance of cash flow. You can get closer to the 1% rule than an “A” class home, but the main financial benefit for “B” properties is long-term appreciation.

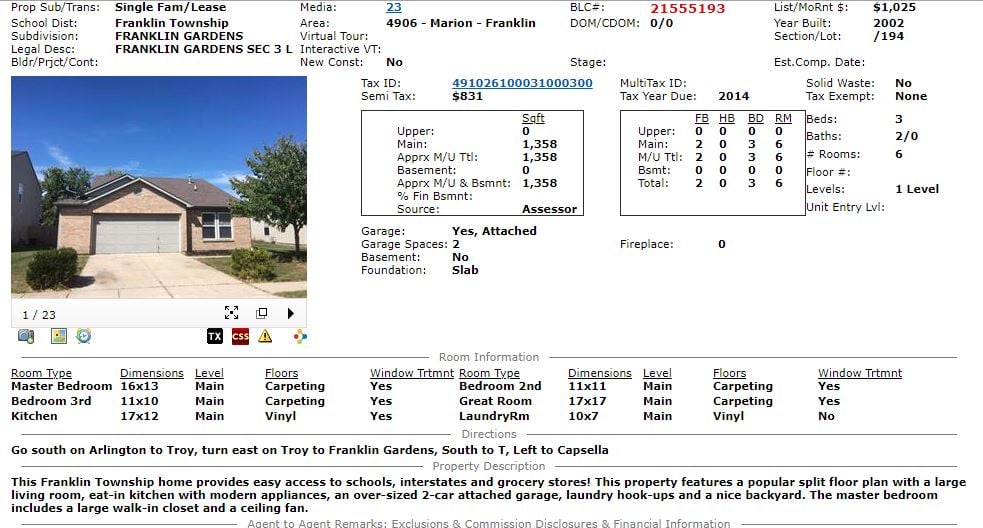

Example:

The property below is a good example a “B” class home that we currently manage.

We consider this a “B” class home because it:

- Is getting on the older side at 17 years

- Is located in Franklin Township, a popular area in south, central Indiana with a good school system

- Is in perfectly good condition, but is not equipped with the most updated, high-end amenities

- Market rent is around $1,500

- Would likely sell in the $200,000-$215,000 range

“C” Class Properties

It could be argued that “C” class properties are the most popular in our market as far as investing goes.

With price points in the $70,000-$140,000 range, there’s a very low barrier to entry.

The price often reflects the condition though. These properties are typically not in the best shape, usually 30 years or older, and will have deferred maintenance issues.

They’re usually found in less desirable areas which tends to attract lower quality tenants.

These variables equate to a pretty high risk factor so just know what you’re getting into when you purchase a “C” class property.

Pros: With the lower price points that “C” class properties offer, you’ll likely see more cash flow than the previous two classes combined. If that’s an important factor for you, then this may be the way to go.

Cons: Although you may see solid cash flow, you’ll likely have to deal with problem tenants and excessive maintenance with many “C” class investments. Many of the locations of these properties will also hinder any sort of long-term appreciation.

However, keep in mind, there are certain areas that we would consider “C” class on paper, but have had great performance. As Central Indiana continues to grow and gentrify, many areas are right on the cusp of being “B” class.

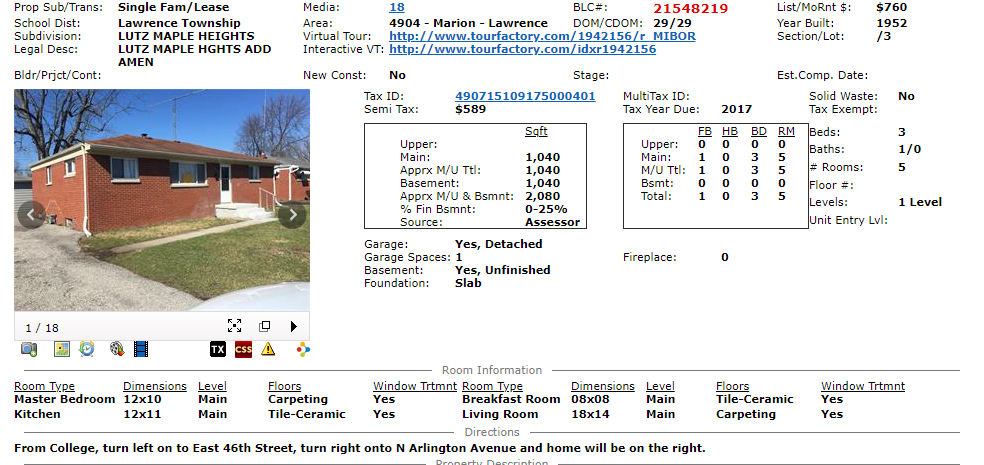

Example:

This next property is a great example of a “C” class home.

We categorize this as a “C” because it:

- Was built in 1952 making it relatively old

- Is located in the southern part of Lawrence Township which is not a bad rental area, but compared to many other parts of Central Indiana, it is not extremely desirable to higher quality tenants

- Will inevitably have maintenance issues due to its age and will need updating

- Rents for $1,025

- Would likely sell in the $115,000-$120,000 range which is close to the 1% rule giving you a decent chance at cash flow

“D” Class Properties

To finish up our property class breakdown, let’s discuss the “D” class.

In this context, “D” could stand for distressed, disgusting, drab, dreary, damaged…you get the

These properties are the lowest of the low.

They’re often found in the worst neighborhoods, often riddled with crime, surrounded with boarded up eyesores.

If you remember the Oceanpointe debacle that took place here not too long ago, those are the types of properties we’re dealing with – severely neglected, often uninhabitable dwellings.

You can often find these properties at prices less than $20,000.

Pros: I really don’t feel like I can list anything here, there’s not much upside to investing in these types of homes.

Cons: Basically everything that was mentioned throughout this entire section. While the dirt cheap prices may entice you to try it out, if you don’t know what you’re doing, you’re in for a massive headache and money pit if you decide to invest in “D” class properties.

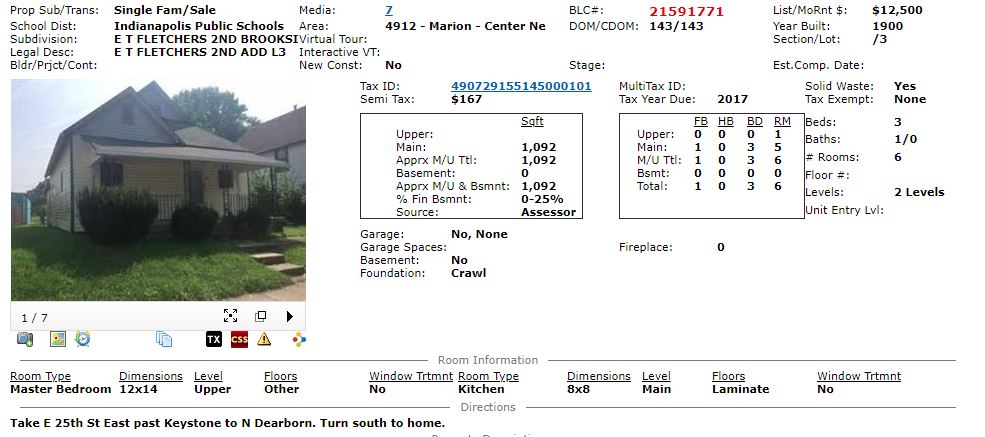

Example:

We obviously don’t manage or own any properties that would fall into this category. But I found the property below on the MLS for reference.

This property is a classic example of a “D” grade because it:

- Was built in 1900 making it prone to maintenance issue right off the bat

- Is located in a very undesirable area with high crime rates and low quality tenant pools

- It is in complete disarray, is unlivable, and would take a LOT of time and money to get it rent ready

- Would likely rent in the $800 range

- Sold for a whopping $12,500

This is by no means the end all, be all grading scale for Indianapolis rental properties.

But, as a local company who has been in the game for over 10 years now, we’ve seen and experienced a lot.

We hope our humble and educated opinion has helped you learn more about the Central Indiana market and understand which property class(es) are a good fit for your investment goals.